Anthony Pritzker, a prominent figure in the private equity world, has amassed a substantial fortune through calculated risks and a keen understanding of market dynamics. His success isn't solely attributable to his family's legacy; it's a testament to his strategic investments and astute business acumen. This article delves into the key elements that have contributed to his impressive net worth, examining his career trajectory, investment strategies, and philanthropic endeavors.

The Pritzker Legacy: A Foundation for Success

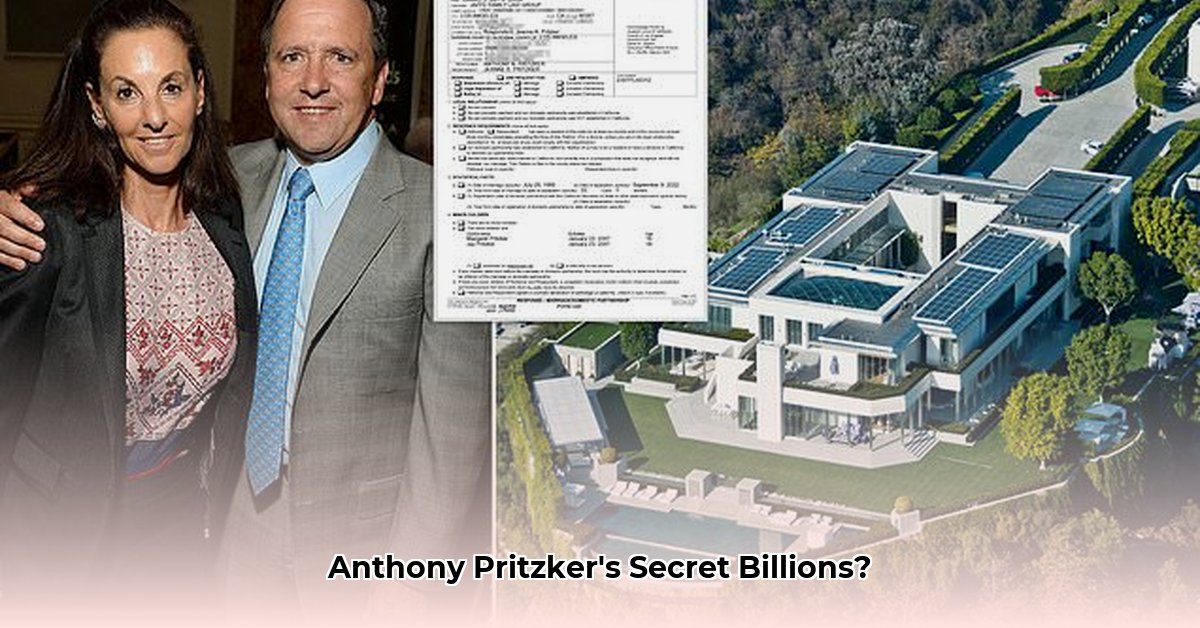

Anthony Pritzker's journey is inextricably linked to the renowned Pritzker family, known for its entrepreneurial spirit and significant holdings, most notably in the Hyatt Hotels chain. This established foundation provided him with invaluable resources, a strong network, and a significant head start. However, his achievements extend far beyond inheriting a family fortune; he has actively built a formidable career in his own right, demonstrating exceptional business savvy and a commitment to innovation. The family's history of successful ventures laid a crucial groundwork, but it's Anthony's individual strategic decisions that have truly propelled his net worth to its current levels.

Pritzker Private Capital: A Strategic Shift

A pivotal moment in Anthony Pritzker's career was the founding of Pritzker Private Capital (PPC) in 2007. This marked a significant strategic shift from solely family-controlled investments to a larger-scale operation that incorporated outside investors. This move allowed for increased investment capacity and diversification across various sectors, showcasing Anthony's ambition and adaptability. The success of PPC is directly tied to the immense growth of his personal net worth. The firm's impressive fundraising success, attracting billions in committed capital, underscores investor confidence in Anthony's leadership and investment strategy.

Investment Strategy: Calculated Risks and Diversification

Anthony Pritzker's investment approach is characterized by calculated risk-taking and strategic diversification. He avoids over-concentration in any single sector, mitigating potential losses through a broad portfolio. His willingness to invest in high-growth, albeit high-risk, ventures, such as SpaceX, exemplifies this strategy. This approach reflects a confidence in his ability to identify undervalued opportunities and a willingness to embrace uncertainty. How does such a risk-averse yet high-growth strategy work? It's a balance between thorough due diligence and understanding the potential rewards outweighing the inherent risk.

Key Investments: Building a Multi-Billion Dollar Portfolio

While precise details regarding his investment portfolio remain private, it's clear that his investments span several sectors, including industrial manufacturing, packaging, and the burgeoning space exploration industry. Each investment decision appears deliberate and strategic, reflecting his ability to identify high-potential companies and capitalize on market trends. This targeted approach, combined with rigorous due diligence, is a significant contributor to his substantial net worth. What's the common thread? A focus on strong management teams and companies poised for significant growth.

Philanthropy: Giving Back

Beyond his business endeavors, Anthony Pritzker is a significant philanthropist, demonstrating a commitment to social responsibility. His investments in charitable causes contribute to a lasting legacy beyond his financial success. This reflects not just financial success, but a commitment to broader societal impact, which is a significant part of his overall profile. This is also a strategic move for strengthening the brand and trust around his business venture.

Challenges and Future Prospects

The private equity landscape presents inherent challenges, including market volatility, economic downturns, and geopolitical uncertainties. Succession planning within PPC is also crucial for the firm's long-term success and thus, the sustenance of Anthony's wealth. Addressing these factors requires strong leadership and foresight—qualities that Anthony has consistently demonstrated throughout his career. The future trajectory of both PPC and Anthony Pritzker's net worth will depend on his ability to navigate these challenges and continue to adapt to the ever-changing market conditions. How will he handle the next market downturn? This is the question we can look forward to being answered in the future.

Conclusion: A Legacy of Strategic Investment

Anthony Pritzker's journey exemplifies the power of strategic diversification, calculated risk-taking, and a deep understanding of market dynamics. His success is a testament to his business acumen and a legacy built on both family history and his own remarkable achievements. The future of his empire remains an exciting prospect to monitor, as his continuing efforts to adapt to change and capitalize on new opportunities will undoubtedly shape his and PPC's future trajectory, and by extension, his net worth.